The Best Guide To Kam Financial & Realty, Inc.

The Best Guide To Kam Financial & Realty, Inc.

Blog Article

The Best Strategy To Use For Kam Financial & Realty, Inc.

Table of ContentsHow Kam Financial & Realty, Inc. can Save You Time, Stress, and Money.Top Guidelines Of Kam Financial & Realty, Inc.The Ultimate Guide To Kam Financial & Realty, Inc.Kam Financial & Realty, Inc. Things To Know Before You Get ThisThe Main Principles Of Kam Financial & Realty, Inc. The 15-Second Trick For Kam Financial & Realty, Inc.The Facts About Kam Financial & Realty, Inc. Uncovered

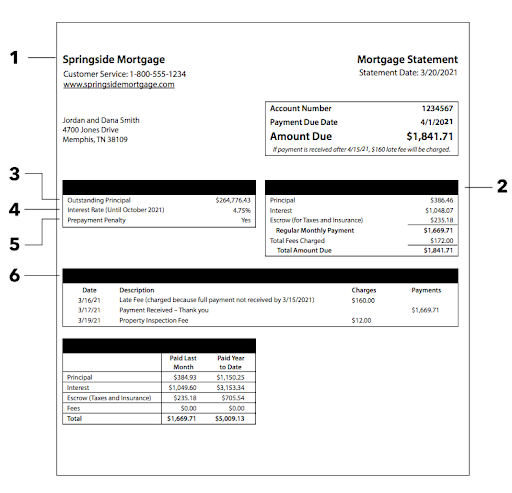

The home acquiring procedure includes numerous steps and variables, meaning each individual's experience will certainly be special to their family, monetary situation, and preferred residential property. That doesn't imply we can't aid make feeling of the home loan process.A is a type of finance you make use of to purchase residential or commercial property, such as a home. Typically, a lending institution will give you a collection amount of money based on the worth of the home you desire to purchase or own.

Not known Factual Statements About Kam Financial & Realty, Inc.

To get a mortgage, you will need to be a minimum of 18 years of ages. Variables that assist in the home loan procedure are a reputable earnings resource, a strong credit history, and a moderate debt-to-income ratio. (https://us.enrollbusiness.com/BusinessProfile/6958795/KAM%20Financial%20&%20Realty,%20Inc.). You'll find out more concerning these factors in Module 2: A is when the house owner obtains a brand-new mortgage to change the one they presently have in place

A features similarly to a very first mortgage. You can borrow a fixed amount of cash based upon your home's equity, and pay it off with fixed regular monthly settlements over an established term. An operates a bit differently from a conventional mortgage and is comparable to a credit scores card. With a HELOC, you obtain authorization for a fixed amount of money and have the versatility to borrow what you need as you require it.

This co-signer will certainly accept pay on the home loan if the consumer does not pay as concurred. Title firms play a crucial function making certain the smooth transfer of building ownership. They investigate state and county records to validate the "title", or ownership of your house being purchased, is totally free and free from any other home loans or obligations.

The Ultimate Guide To Kam Financial & Realty, Inc.

In addition, they give written guarantee to the loan provider and create all the paperwork required for the mortgage. A down repayment is the amount of cash you must pay upfront in the direction of the acquisition of your home. For instance, if you are acquiring a home for $100,000 the lending institution might ask you for a down repayment of 5%, which indicates you would be required to have $5,000 in cash money as the down payment to buy the home (california mortgage brokers).

The principal is the quantity of cash you get from the lending institution to get the home. In the above instance, $95,000 would be the quantity of principal. Most loan providers have conventional home mortgage standards that enable you to obtain a particular portion of the worth of the home. The percentage of principal you can borrow will certainly vary based on the home loan program you receive.

There are special programs for newbie home purchasers, experts, and low-income borrowers that permit lower deposits and greater percentages of principal. A mortgage banker can evaluate these options with you to see if you qualify at the time of application. Rate of interest is what the lending institution charges you to borrow the cash to buy the home.

Some Ideas on Kam Financial & Realty, Inc. You Need To Know

If you were to take out a 30-year (360 months) mortgage and borrow that very same $95,000 from the above instance, the overall amount of passion you would pay, if you made all 360 month-to-month settlements, would certainly be a little over $32,000. Your regular monthly payment for this lending would be $632.

When you possess a home or property you will certainly have to pay real estate tax to the region where the home is located. Most lending institutions will certainly require you to pay your tax obligations with your mortgage payment. Real estate tax on a $100,000 loan might be around $1,000 a year. The lending institution will separate the $1,000 by one year and include it to your repayment.

Getting My Kam Financial & Realty, Inc. To Work

Again, due to the fact that the home is viewed as security by the lender, they wish to see to it it's shielded. Homeowners will be required to offer a duplicate of the insurance plan to pop over to this site the lender. The annual insurance plan for a $100,000 home will certainly set you back about $1,200 a year. Like tax obligations, the lender will also offeror in some cases requireyou to include your insurance coverage premium in your monthly payment.

Your payment now would certainly boost by $100 to a brand-new overall of $815.33$600 in principle, $32 in interest, $83.33 in tax obligations, and $100 in insurance policy. The lending institution holds this cash in the same escrow account as your real estate tax and pays to the insurer in your place. Closing costs describe the costs connected with refining your financing.

What Does Kam Financial & Realty, Inc. Do?

This guarantees you understand the overall price and agree to continue before the loan is funded. There are lots of different programs and loan providers you can select from when you're getting a home and getting a home mortgage that can assist you navigate what programs or choices will certainly work best for you.

The 6-Second Trick For Kam Financial & Realty, Inc.

Many monetary establishments and property representatives can help you understand exactly how much cash you can invest on a home and what car loan quantity you will certainly certify for. Do some research, but also request for references from your good friends and family members. Locating the best companions that are a great fit for you can make all the difference.

Report this page